The first step in purchasing a home is to get pre-approved for a loan. The lender should disclose and review all the typically closing cost, down payment and other common fees. Most of these are disclosures in your Loan Estimate (see sample copy below). Some of these fees are paid after a contract is executed (agree upon and signed) but prior to closing.

The following is a list of the typical fees a buyer will incur prior to closing:

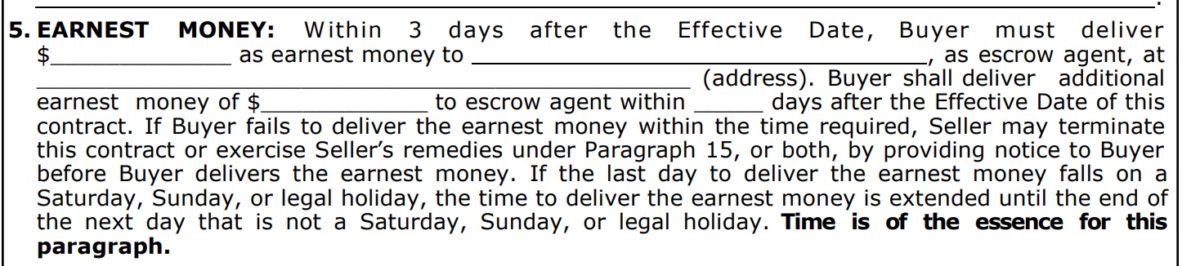

Earnest Money Deposits: This is a cash deposit attached to you purchase offer. The amounts of this deposit varies but expect to pay at least 1% if you are financing the balance and maybe as high as 10% if you are paying cash. Although earnest funds are not required they are expected. If your offer is accepted and you proceed with the purchase, this deposit is applied towards the purchase of your property.

Home Inspections: Every buyer should have their home inspected. This is usually done within 7-10 days of the executed contract. The cost will vary based on the inspection completed and the size of the home. The most common inspections are a general inspection that may run approximately $450 and pest inspections will typically cost $75-$150.

In some cases you might have to inspect the foundation, a water well, a septic tank, etc. and these all have a separate cost.

Option Fee: This is a fee that is paid to the seller for the ability to have your inspection period. This fee will allow you to inspect the home within a given amount of time and back out of the agreement if you do not like the results. The fee varies but typically runs $100-300 for a 7-10-day period. Money well spent if it allows you to back out of the contract as a result of a bad inspection.

These funds can be credited to the purchase of your home if you proceed with the contract; if you decide to back out, you forfeit the funds.

Appraisal: If you are financing your home purchase, the bank will want to appraise your home. The purpose of an appraisal is to make sure the home you are purchasing is worth the amount you agreed to pay. The bank will not want to finance 100K for a home that is valued at 80K.

Appraisals typically cost approximately $450-$550. Your agent should coordinate with the lender so that this is ordered after the inspection period has passed.